A former Speaker of the House of Representatives, Hon. Yakubu Dogara, has said President Bola Tinubu inherited nothing short of economic “debris” when he assumed office in May 2023.

Dogara, who is the Chairman of the National Constitutional Governance Council (NCGC), also said the Nigeria Tax Act 2025 represents a structural shift toward a modernised, consolidated tax system aligned with international standards.

This comes as the Minister of Budget and Economic Planning, Senator Abubakar Atiku Bagudu warned that Nigeria must attract at least $100 billion in combined public and private investments every year to stand a chance of achieving the ambitious goals set out in its Agenda 2050 development framework.

Bagudu, who gave the warning on Tuesday at a one-day policy dialogue in Abuja, cautioned that without bold reforms and stronger synergy between the legislature and the executive, the country could slip further behind its peers in global economic competitiveness.

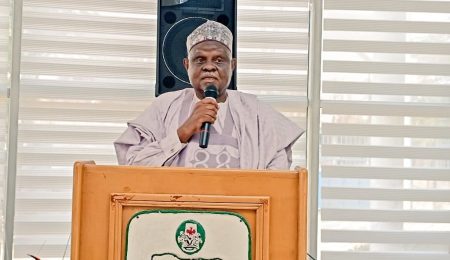

Dogara spoke on Tuesday, in Abuja, while presenting a paper titled: “Navigating Tax Reform in Nigeria: Insights on President Tinubu’s Policies,” at the maiden distinguished parliamentarian lecture.

He explained that by the time President Bola Tinubu took office, the economic debris of the nation had become too conspicuous to be ignored.

Dogara recalled that N22.7 trillion had been printed and injected into the economy in the name of ways and means, thereby destroying the value of the Naira in “our pockets.”

He noted that the dual exchange rate meant that some “anointed people” were making hundreds of millions of Naira off forex allocations from the Central Bank of Nigeria (CBN) without producing any goods or offering any services whatsoever, and tying crude sales to foreign loans in the name of forward sales of crude was fast becoming the order of the day.

Dogara pointed out that some of the foreign loans had been procured to help strengthen the Naira, a measure that could only be sustained by “voodoo economics.”

He said from day one, it was very clear that something urgent, nay revolutionary, must be done to prevent the economy from imploding.

According to him, “So, the President’s job as an economic reformer began on day one. Every reformer knows that progress is not promised; it is always fought for.

“All that a reformer is bothered with is to do the right things, not to have all things under control. As a matter of fact, if everything seems under control, it is not only an indication that you are not going fast enough, you are most probably not a reformer.”

Dogara stressed that Tinubu knew that for the country’s democracy to be worth its name, it must offer more than political and individual freedoms; it must offer economic choices which would lead to economic justice, most especially for the vulnerable who are least likely to recover from economic shocks.

He said while the tax law promises greater clarity and potentially higher revenue mobilisation, its success depends on predictable implementation, detailed regulations, and meaningful investments in administrative capacity and taxpayer readiness.

The former lawmaker was of the opinion that tax reform was not a punishment but a pact, said citizens must accept that the reform was more than a policy change, but a national conversation.

He emphasised that in order to reform the obsolete tax laws, the President set up the Presidential Committee on Fiscal Policy & Tax Reform, chaired by Prof. Taiwo Oyedele.

Dogara noted that the committee came up with revolutionary reform proposals that will ultimately restructure laws, norms, and institutions to create a more just and equitable society.

He said reform efforts often face significant opposition from those who benefit from the status quo, requiring strategic planning, persistent advocacy, and coalition-building to overcome these obstacles, saying this was no exception.

Dogara explained further that the opposition to the reform was fierce and furious, almost foisting negative solidarity, which could lead to a race to the bottom and collective decline where everyone is forced to endure worsening conditions because no one feels capable of improving them.

He said it was against this background that they raised issues that, even if true, were trivial, but as they related to the core goals of the reform, the issues were both trivial and untrue.

He stressed that it was clear that the opposition was primarily motivated by something sinister other than a collective benefit or shared ideal.

The former Speaker said for decades, the country’s tax system had been a complex, sometimes contradictory, web of ordinances and Acts.

He said it was a system where too few shouldered the burden of too many, where enforcement was inconsistent, and where informality was the norm, not the exception.

Dogara added, “Tax reform is not a punishment. It is a pact. On our part, as citizens, we must accept that this reform is more than a policy change; it is a national conversation. It is we telling ourselves that we are ready to build the Nigeria we deserve.

“Therefore, from the market stalls of Kano, Onitsha to the corporate hubs of Lagos, let every legitimate enterprise become a thread in the strong fabric of our national revenue.

“The government must also understand that true tax reform is not about raising rates, but about raising trust. It is the covenant between a government’s promise and a people’s prosperity. This is because transparency is the engine of compliance.

“When citizens can see where their Naira goes, they are proud to give it. For it was not in vain that Lester B. Pearson, former Prime Minister of Canada reminded us that, “the best way to teach people to pay their taxes is to let them see what they get for it.

“Let this reform be a pact between the government and the private sector—a promise that if we contribute diligently, the government will deploy those resources responsibly to build the roads we drive on, power the industries we run, build world class hospitals for us and educate the talent we hire.

“The waters ahead may be uncharted, but the destination is clear: a self-reliant, economically vibrant, and globally competitive Nigeria

“The Nigeria Tax Act 2025 represents a structural shift toward a modernised, consolidated tax system aligned with international standards.”

Baring his mind on the five per cent fuel surcharge in the new tax laws, he said surcharge was not a new tax introduced by the current administration, adding that the provision already exists under the Federal Roads Maintenance Agency Act, 2007 as amended.

He added: “Government has said that it is restated in the new Tax Act just for harmonisation and transparency rather than for immediate implementation.

“It is also important to underpin the fact that the surcharge will not apply to all fuel products. Several energy products used by households are exempt. These include household kerosene, cooking gas (LPG), and compressed natural gas (CNG). Clean and renewable energy products are also excluded to align with Nigeria’s energy transition agenda.Adedayo Akinwale and Sunday Aborisade

Follow us on: