Africa’s richest person has withdrawn a lawsuit filed to compel Nigerian authorities to restrict fuel imports, launched around the time his massive refinery began producing petrol, a blood report said on Wednesday.

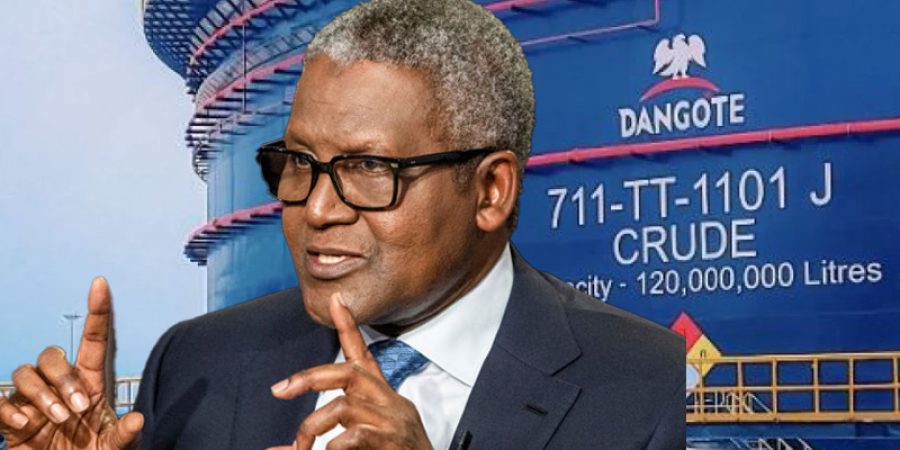

Dangote Refinery, owned by Aliko Dangote, filed a notice at a Federal High Court in the capital, Abuja, on Monday, seeking to discontinue the case, according to a court document seen by Bloomberg. No reasons were given.

The withdrawal suggested relations with the government may be thawing after last year saw Dangote battling with authorities on multiple fronts. The giant refinery filed the lawsuit against Nigeria’s regulator, several fuel importers, and the state-owned Nigerian National Petroleum Company Limited (NNPC) in September, the same month it began producing gasoline.

Dangote argued at the time that the regulator was violating its own laws by allowing fuel imports. Farouk Ahmed, head of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), said the lawsuit was “not good for the nation” in terms of energy security and “not good for markets” due to concerns about creating a monopoly.

The billionaire pitched his $20 billion refinery as crucial to meeting all of Nigeria’s petrol needs. However, it has struggled to keep pace with local demand, supplying only about 15 million of the 48 million litres required daily in June, according to regulatory documents seen by Bloomberg.

The gap has been filled by imports, though this is expected to change when the refinery, currently operating at 85 per cent capacity, ramps up to its full processing capacity of 650,000 barrels of crude per day.

Meanwhile, oil refiners in India may be looking at diversifying some buying away from Moscow after fresh European Union (EU) sanctions on the Kremlin, with focus now on Nigeria and other countries.

Local processors are exploring options on some inputs, according to traders and refinery executives, who asked not to be identified discussing private matters.

Indian refiners are now reaching out more widely for crudes, with supplies being bought from places including Azerbaijan and Nigeria, as well as the United Arab Emirates, according to the traders.

Local processors are exploring options on some inputs, although it’s too early to say that they’ve switched out of typical Russian supply in a major way, according to traders and refinery executives, who asked not to be identified discussing private matters with Bloomberg.

The global oil market is assessing the fallout from the EU’s latest wave of curbs, which included sanctions against a major Indian refiner that’s part Russian-held, a lower price cap, as well as imports of petroleum products made from Moscow’s crude.

At the same time, investors are also contending with moves by OPEC+ to restore shuttered production, and the fallout from the US’s multi-front trade war.

Indian refiners are now reaching out more widely for crudes, with supplies being bought from places including Azerbaijan and Nigeria, as well as the United Arab Emirates, according to the traders. Like all major economies, India typically sources oil from a wide array of countries.

Among recent purchases, state-backed Mangalore Refinery & Petrochemicals Ltd. sought crude for late August to September delivery to New Mangalore, the traders said. That’s prompter-than-usual, they said, with the refinery eventually taking about 1.3 million barrels of Azeri oil. That’s also a type not typically bought by Indian processors, Bloomberg said.

Elsewhere, Hindustan Petroleum Corp. purchased West African crudes including Nigeria’s Bonny Light, Egina and Qua Iboe. In addition, private refiner Reliance Industries Ltd. bought Abu Dhabi’s flagship Murban grade — a premium crude that’s typically costlier compared with its staple diet of heavy Russian and Middle Eastern crudes.

Emmanuel Addeh

Follow us on: