The Bureau of Public Enterprises (BPE) has announced plans to list two electricity distribution companies (DisCos)and one generation company (GenCo) on the Nigerian Exchange through Initial Public Offerings (IPOs).

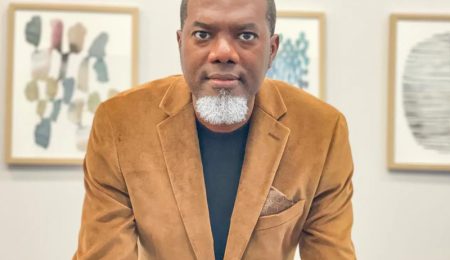

BPE Director-General, Mr. Ayodeji Gbeleyi, disclosed this during a media briefing in Abuja on Tuesday.

“Today, networks are being considered for IPO. We see that sector as potentially a good candidate for an IPO on the Nigerian Exchange, and we are currently working on that as well,” he said.

However, Gbeleyi declined to reveal the names of the specific companies, citing confidentiality.“On the IPOs of potential DisCos and GenCos, at this stage, because of transaction confidentiality, we are not in a position to disclose out of the 11 DisCos, which are the two.And we are also unable to disclose the GenCo that is the target for confidentiality and in order not to create anxiety or apprehension—be it on the labour side, be it on the workers’ side, the company or be it on the larger society,” he explained.

The DG also revealed that shareholders’ loan agreements were recently executed for 10 of the 11 DisCos, with disbursements set to begin soon.

On the planned privatisation of five GenCos, he explained that the process had been suspended due to exchange rate volatility.“The transaction is held in abeyance. It was in the middle of the transaction we recorded a massive exchange volatility. When the transaction started in 2021, exchange rate officially was around N450. As at last year, exchange rate was averaging N1,600. Today, it’s N1,575. So, the fundamentals of the transaction changed along the line. But government is still keeping an eye on it,” Gbeleyi said.

He further noted that GenCos have not taken advantage of the eligible customer regulation because of transmission challenges.“An eligible customer will also need transmission capability. If you produce power in Zungeru and you need to sell power in Egbin, there must be transmission infrastructure for you to dispatch that power. It is not just about the eligible customer, but also the wheeling infrastructure to deliver,” he explained.

Gbeleyi stated that the core investors of four DisCos remain intact, while seven have been restructured. He also highlighted the unbundling of the Transmission Company of Nigeria (TCN), which created the Nigerian Independent System Operator (NISO) to promote market independence and efficiency.

On metering, he reported growth from 403,255 meters in 2013 to 6,468,036 as of March 31, 2025, including 3.2 million from the $500 million Distribution Sector Recovery Program (DISREP) and 2.5 million under the Presidential Metering Initiative.

On refineries, Gbeleyi stressed flexibility:“Nothing is cast in stone on the privatisation of refineries. We are working to achieve the very best for Nigeria. These things are all driven by financial models… For us, it could be concessioning, it could be the NLNG model. But the priority is to stop the bleeding and stop the leakages.”

He said the federal government is projected to generate N312.3 billion in 2025 from asset sales or privatisation, adding that BPE remains committed to contributing to President Tinubu’s Renewed Hope Agenda, aimed at achieving a $1 trillion economy and creating 50 million jobs.

Nigeria, he added, has a $2.3 trillion infrastructure deficit, requiring an average of N100 billion annually over 23 years.

Kasim Sumaina

Follow us on: