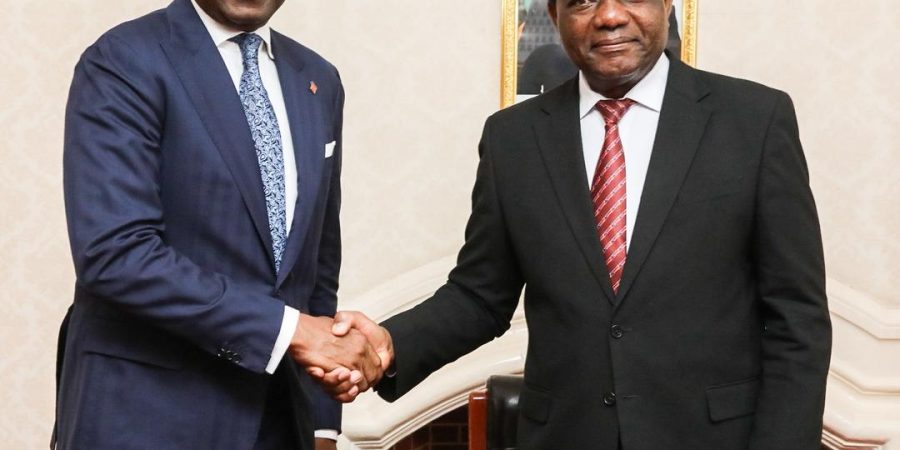

Access Holdings PLC has reaffirmed its commitment to supporting Zambia’s energy and agriculture sectors, following a high-level meeting with President Hakainde Hichilema at the State House in Lusaka.

During the discussion, President Hichilema highlighted the country’s challenges in power generation and transmission, emphasising the need for increased investment following recent open access reforms. He also stressed the pivotal role banks can play in supporting other critical sectors, including agriculture and digital transformation, which are central to Zambia’s growth strategy.

Commending the Zambian government’s bold economic reforms, particularly in the energy sector, Aigboje Aig-Imoukhuede, Chairman of Access Holdings, said: “Access Holdings stands ready to finance transformative projects that will strengthen Zambia’s power generation, transmission, and distribution capacity. Our financing arrangements of up to $100 million are designed to catalyse development in sectors that matter most to the economy.”

Lishala Situmbeko, CEO of Access Bank Zambia, revealed that the bank is already partnering with IDC subsidiaries and is evaluating an investment of 450 million kwacha into critical infrastructure projects.

With energy playing a pivotal role in enabling industrial growth—especially in mining, where copper production is projected to reach 1 million metric tonnes by year-end—Access Holdings’ investments are expected to ensure a reliable power supply and stimulate broader economic expansion.

Beyond energy, the group reaffirmed its commitment to supporting Zambia’s agriculture sector and advancing digital transformation, in line with the government’s growth agenda.

Special Assistant to the President for Finance and Investments, Jito Kayumba, and Economic Advisor to the President, Pamela Nakamba, praised Access Holdings’ proactive approach, noting that the group’s investment strategy aligns closely with national priorities and the country’s broader economic objectives.

As a leading African financial services group, Access Holdings remains dedicated to supporting both the Zambian government and private sector stakeholders to deliver sustainable economic impact.

Access Holdings PLC is a non-operating financial holding company headquartered in Lagos, Nigeria, and licensed by the Central Bank of Nigeria. Established in 2022, the company operates through five subsidiaries: Access Bank Plc, Hydrogen Payment Services Company Limited, Access ARM Pensions Limited, Access Insurance Brokers Limited, and Oxygen X Finance Company Limited.

The Group serves its markets through corporate and investment, commercial, and retail banking segments. Following its merger with Diamond Bank in 2019, Access Bank Plc became one of Africa’s largest retail banks by customer base and Nigeria’s largest bank by total assets, with more than 700 branches across three continents, over 20 countries, and serving over 60 million customers.

Other subsidiaries provide fintech, pension administration, insurance, and digital consumer lending solutions, leveraging the Access Group ecosystem to deliver sustainable, impactful financial services across Africa.

Boluwatife Enome

Follow us on: