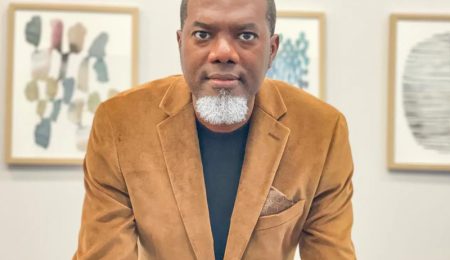

Former President of the Chartered Institute of Taxation of Nigeria (CITN), Samuel Agbeluyi, says Nigeria is finally operating a truly functional Value Added Tax (VAT) system, following the passage of landmark tax reform bills by the National Assembly.

Describing the development as “a major positive step for Nigeria’s economy,” Agbeluyi, in an interview with ARISE NEWS on Friday, said the VAT reforms, which now allow businesses to offset input VAT against output VAT, correct a long-standing distortion that unfairly taxed enterprises and stifled growth.

“What we have before now has been at best sales tax, whereby it was cumbersome to get back your input VAT, because the process is whatever is your input, you match, you set off against your output, the net is what you pay to government. But that was difficult. It was difficult to set off the input, as if the companies were not spending money to do business or service. Government was just interested in the output. Now some of this input will be set off against the output. And of course, the net will be paid to the government,” he explained.

The tax expert praised the broader reforms for modernising Nigeria’s outdated tax framework and making it more reflective of economic realities.

He said, “What we have before now we have a lot of what I call the multiplicity of taxes and some of the laws are so archaic that you can’t relate with the fine and the penalty… and now we have what you can relate with that is contemporary in nature.”

Agbeluyi also highlighted the reforms’ provisions for small businesses and low-income earners, calling them a welcome relief for vulnerable groups in a struggling economy. With the corporate tax threshold now raised to ₦50 million in annual turnover, small enterprises falling below that figure are exempt from Company Income Tax (CIT), VAT, and Withholding Tax (WHT).

““If you go to the company, before now, the threshold for exemption from company income tax, VAT and withholding tax deduction has been 25 million. This threshold has been increased to 50 million, meaning that if you are in business and your activities, your turnover in a year is within 50 million or below, then you are not going to do any of this obligation to the government. In addition to that, under the VAT Act, this is the time I can say that Nigeria is actually going to have the proper VAT regime,” he said, describing the move as a strong incentive for business sustainability.

Minimum wage earners are now also fully exempt from personal income tax, while middle-income earners are expected to see lower tax obligations, potentially increasing their spending power and stimulating economic activity.

However, Agbeluyi cautioned that the success of these reforms depends largely on technological readiness, especially at the sub-national level. He noted that only about 10 to 15 states currently have the capacity to implement these changes effectively, while others lag behind in terms of digital infrastructure.

He also emphasised the need for data integration and inter-agency cooperation, calling for the use of tools like BVN, NIN, and financial records to improve tax identification and administration nationwide.

Agbeluyi concluded that while implementation challenges remain, the passage of the tax reform bills has laid the foundation for a fairer, smarter, and more investment-friendly tax system that could help power Nigeria’s economic transformation.

Ozioma Samuel-Ugwuezi

Follow us on: